The recently developed ability to accept card payments on an ordinary smart phone, with no additional hardware, has electrified the payments industry. But the technology, known as SoftPOS, comes with complications that could slow progress, a panel of experts warned Thursday. SoftPOS, which as the name implies relies on specialized …

August, 2023

-

25 August

Affirm’s Revenue up, Though Loss Broadens And Other Digital Transactions News briefs from 8/25/23

Buy now, pay later provider Affirm Inc. posted fiscal fourth quarter revenue of $445.8 million, up 22.4% from $364.1 million in the quarter ended June 30, 2022. Its quarterly loss of $206 million broadened from $186.4 million a year ago. For the full year, Affirm had $1.588 billion in revenue, up 17.7% …

-

24 August

Fiserv’s Open Banking Move with Akoya Eases Secure Credential Sharing

Fiserv Inc. is working with data aggregator Akoya LLC to enable consumers to share their financial data with fintech and third-parties with which they do business in a way that doesn’t expose a consumer’s full banking credentials. The partnership will provide Fiserv with access to consumer data from Akoya’s network …

-

24 August

BNPL’s Rapid Ascent Evokes Clashing Opinions on the Ethics of Short-Term POS Credit

The buy now, pay later craze, which took flight during the Covid pandemic, has turned into a $70-billion-plus segment of the payments industry. But that doesn’t mean it hasn’t stirred controversy among acquiring-industry executives, some of whom manage versions of the point-of-sale credit product. That clash of viewpoints emerged Wednesday …

-

24 August

BNPL for Workplace Training And Other Digital Transactions News briefs from 8/24/23

OSHA Outreach Courses, which provides workplace training services to employers and employees, said it has added a buy now, pay later option to pay for its instructional offers. Shift4 Payments Inc. has been named the official payment processor for the Cleveland Cavaliers of the National Basketball Association. Shopmium, a cash-back shopping …

-

23 August

ID Theft Spurs Consumer Security Changes, an ITRC Survey Finds

Most victims of identity theft—53%—began using different passwords across multiple accounts, a move that could reduce their fraud exposure in the future, found a survey from the Identity Theft Resource Center. Typically, though, 59% of consumers use the same password across multiple accounts, the ITRC’s 2023 Consumer Impact Report found. …

-

23 August

Gen Zers Lead the Charge as Canadians Embrace Mobile Debit Transactions

In-store debit card payments made using mobile devices in Canada surged 53% during the 12-month period ended July 31, compared to the same period a year earlier, according to Interac Corp., Canada’s national debit network. In addition, e-commerce transactions made using a mobile device increased 17% year-over-year during the same …

-

23 August

TouchBistro Updates POS System And Other Digital Transactions News briefs from 8/23/23

Restaurant point-of-sale provider TouchBistro launched a set of back-of-house technologies, including profit-management and kitchen display systems. Payments provider NMI released first-half 2023 results indicating the company ended the period with connections to more than 3,900 independent software vendors, sales agents, and fintechs. So far, these links have generated more than 2.3 billion transactions and …

-

22 August

New Jersey Limits Card Surcharging to Merchants’ Processing Fees

New Jersey has implemented a law that prohibits merchants in the state from profiting from credit card surcharging and requires merchants to clearly disclose any surcharges to consumers. The law, which was passed by the New Jersey legislature in June and went into effect immediately upon New Jersey Governor Phil …

-

22 August

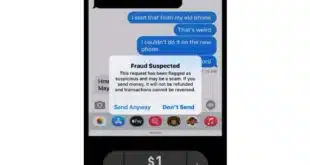

Sephora Is the First Client for J.P. Morgan Payments’ Tap to Pay on iPhone Service

Add Sephora, a beauty retailer, to the list of merchants adopting iPhones as payment-acceptance devices in the Tap to Pay on iPhone program. J.P. Morgan Payments says Sephora is its first such retailer to adopt the contactless-payment service, which does not require special hardware to complete a transaction. Announced Tuesday, …