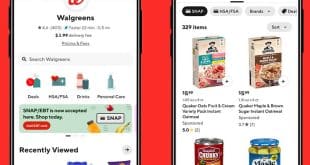

One of the first moves to bring a payment system not controlled by Apple Inc. to Apple’s App Store emerged Thursday and follows a landmark federal-court ruling last month. Paddle Ltd., a London-based payments provider, said it will begin offering the alternative Dec. 7, in line with the terms of the ruling, and will charge App Store sellers commissions well below the transaction fees levied by Apple.

Paddle said commissions to developers using its In-App Purchase alternative will range from 5% on transactions over $10 to 10% on purchases under $10. Apple’s commissions range from 15% to 30% and have long been a bone of contention for app sellers on the highly popular platform. “Our alternative In-App Purchase offering gives developers the chance to retain all the things they like about the App Store, while also giving them greater control and lower costs,” Christian Owens, Paddle’s founder and chief executive, said in a statement.

The 9-year-old company adds that its service will funnel more customer data to App Store sellers than what is available from Apple and will assume the burden of handling customer support and sales-tax administration.

Paddle’s move to attract iOS developers on the App Store follows a ruling Sept. 10 by a federal judge for the Northern District of California. Among other matters, her decision requires Apple to open the App Store to payment options beyond the company’s own system. Nonetheless, the ruling, which came in a lawsuit filed in 2019 by Epic Games, held the App Store’s design is legal and that the computing giant is not exercising an illegal monopoly when it comes to payments processing for mobile games.

That ruling followed a settlement reached in August in connection with the case. In the settlement, Apple agreed to let developers selling on the App Store tell customers by email that they can pay for products and services by means other than Apple’s own payment platform. Under the terms of the settlement, app makers still cannot communicate payment options via the app itself. Also, developers must obtain consumer consent for any options they use to charge consumers for apps or in-app products.