Most U.S. consumers—53%—concerned about a possible fraudulent transaction on their credit card statements make the first inquiry with the issuing bank, not with the merchant. That’s according to the newly released 2024 Cardholder Dispute Index released by Chargebacks911, a Clearwater, Fla.-based dispute-management company. Conducted in partnership with TSG, an Omaha, …

Read More »Search Results for:

Huntington’s Secure Card And Other Digital Transactions News briefs from 1/30/24

The Huntington National Bank launched a secured credit card offering 1% cashback rewards and no annual fee. Secured cards require cardholders to make a one-time, refundable deposit to back activity on the card. Mastercard Inc. and BOK Financial Corp. expanded their agreement making Mastercard the exclusive payments network in BOK’s debit and …

Read More »Visa Revenue up 9% And Other Digital Transactions News briefs from 1/26/24

Visa Inc. reported $8.6 billion in net revenue for its December quarter, up 9% year-over-year, on $3.9 billion in credit and debit card volume, up 7.8%. Apple Inc. announced changes to iOS, Safari, and its App Store to meet European Union rules, including new options on its App Store to use payment …

Read More »Eye on BNPL: Klarna Debuts a Subscription Service; PublicSquare Enlists Credova

Klarna AB, a buy now, pay later provider, is entering the subscription arena with the U.S. launch of Klarna Plus. For $7.99 a month, Klarna Plus enables eligible consumers to earn double rewards points on their purchases, pay no service fee when using Klarna at merchants outside of the Klarna …

Read More »Debit a Favored Subscription Choice And Other Digital Transactions News briefs from 1/23/24

Subscription management specialist Recurly Inc. released its 2024 State of Subscriptions report that found 45.5% of consumers chose debit as the subscription payment method, followed by credit cards, 33%, PayPal, 19.3%, and other alternative payment methods, 2.2%. Wise, a platform for international money transfers, said junk fees associated with credit cards and …

Read More »Consumers Are Spending More On Gift Cards As P2P Apps Open As a Channel

Prepaid card spending is on the rise, according to Fiserv Inc.’s annual Prepaid Consumer Insights Study. Some 69% of consumers surveyed say they purchased the same number of gift cards, or more, in 2023 compared to 2022. In addition, 40% of buyers are putting at least $50 on gift cards, …

Read More »COMMENTARY: Streamlining Payments with Straight-Through Processing

In today’s fast-paced business landscape, efficiency and quality are essential for staying ahead of the competition. Straight-through processing (STP) is a solution that enables businesses to expedite financial transaction processing while reducing errors and eliminating repetitive tasks. In both accounts payable and accounts receivable, STP can transform the way payments …

Read More »Eye on Point-of-Sale: Sound Payments POS Updates Are Issued; a New PCI Council Director

Sound Payments issued a slate of updates for its point-of-sale system, including a way for retailers to categorize returns. Jacksonville, Fla.-based Sound Payments says the new return-categories feature enables merchants to catalog returns by size, reason for return, defective, and other custom variables. It also has a reporting component for …

Read More »Lower Costs Plus More Control Could Be Part of Fiserv’s Ambition for a Bank Charter

Giant payment processor Fiserv Inc. wants to take on another aspect of the business with its application for a special bank charter in Georgia. The charter for a merchant-acquirer limited purpose bank, if approved, would enable Brookfield, Wis.-based Fiserv to interact with card networks directly instead of operating through a …

Read More »Eye on NRF; BofA Zelle Users Grow 18% And Other Digital Transactions News briefs from 1/15/24

Banking giant Bank of America Corp. reported combined credit and debit card volume of $228.9 billion for the fourth quarter, up 3% year-over-year. The number of BofA users of the Zelle peer-to-peer payments network grew 18% to 21.5 million, while Zelle volume climbed 25% to $101 billion. Late in 2021, the …

Read More »COMMENTARY: A Rigged International Payments Market Is Bad for the U.S.—And Bad for Free Trade

On Nov. 20, 2023, Mastercard Inc. announced that its Chinese joint venture with Netsunion to process domestic payments had been approved by the People’s Bank of China and the National Administration of Financial Regulation. Was it a victory for, or a mockery of, free trade? If this landmark approval were …

Read More »GoCardless Picks Up JustGiving And Other Digital Transactions News briefs from 1-9-24

GoCardless said it will process open-banking payments made on JustGiving, an online donation platform, replacing American Express Co. FirstOntario Credit Union said it is preparing to launch open banking through connections to Everlink Payment Services Inc. and open-banking technology platform Flinks. The federal government in Canada said in November it planned to …

Read More »GoTab’s Phone Only Point-of-Sale App Debuts

Hospitality point-of-sale system provider GoTab Inc.’s latest product, billed as Phone Only POS, accepts payments on consumer-grade smart phones. It also makes it easier for consumers to pay at the table, GoTab says. The service enables clients to accept contactless credit or debit cards for payment without the need of …

Read More »RDE Views Its CardCash.com Acquisition As a Boost in the Gift Card Market

RDE Inc., owner of Restaurant.com, a popular dining-deals site, has closed on its acquisition of CardCash Exchange LLC, operator of CardCash.com, a secondary gift card marketplace. The deal advances RDE’s presence in gift cards for consumers and merchants. The combined business accounted for more than $100 million in revenue in …

Read More »With 2024 Looming, the EPC Vows to Continue Battling The CCCA

Citing a payments industry that is united in its opposition to the Credit Card Competition Act, research from the Congressional Research Service questioning the benefits of the legislation, and suspect support for the bill among members of Congress, the Electronic Payments Coalition says it is primed to continue its fight …

Read More »A Fee Arrangement Lies at the Heart of a Lawsuit Against Apple, Mastercard, and Visa

An Illinois merchant has filed suit against Apple Inc., Mastercard Inc., and Visa Inc., alleging their efforts to develop Apple Pay prevented competition. Filed last week by Mirage Wine + Spirits in the U.S. District Court for the Southern District of Illinois, the suit specifically claims the agreements among the …

Read More »Visa Launches a Service Aimed at Stopping Fraud Caused by Illegitimate Token Requests

Tokenized credentials are supposed to stop fraud by masking card account numbers when a transaction is processed, but according to Visa Inc. global losses owing to illegitimate tokens totaled $450 million last year. That’s bad enough to prompt the network to announce early Wednesday it is launching Visa Provisioning Intelligence, …

Read More »Discover Taps New CEO And Other Digital Transactions News briefs from 12/12/23

Discover Financial Services said its board of directors has appointed Michael G. Rhodes chief executive and president. Rhodes, who will take office on or before March 6, succeeds interim CEO and president John Owen, who will continue as a Discover board member. Rhodes comes to Discover from TD Bank, where he was …

Read More »Holiday Sales on Cards Are Off to a Healthy Start, the NRF Says

Holiday sales were robust in November, giving merchants reason to be optimistic about overall spending for the holiday shopping season, according to the National Retail Federation. Total retail sales in November, excluding automobiles and gasoline, rose 0.77% month-over-month on a seasonally adjusted basis, and 4.24% on an unadjusted basis year-over-year, …

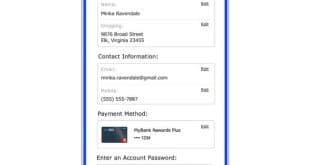

Read More »Software Firm Endava Signs on for an Integration With the Upcoming Paze Wallet

Paze, the upcoming digital wallet backed by banks, has lined up an integration with Endava plc, a software-development firm. Announced Wednesday, the integration, which will be available when Paze launches in 2024, means merchants that use Endava can offer the Paze online checkout. London-based Endava says the simplified checkout will …

Read More »