In the ever-evolving realm of payment processing, independent sales agents require more than just a partner – they need a strategic ally who understands their challenges and provides tailored solutions to propel them forward. Enter Payarc, a game-changer in the industry, offering unmatched support and opportunities that set agents apart …

April, 2024

-

25 April

Eye on BNPL: Splitit Rolls Out Installment Loans At Checkout; Klarna Partners With Uber

Buy now, pay later provider Splitit Payments Ltd. has launched an installment-payment option for financial institutions that consumers can access at the point-of-sale. Financial institutions can offer the option by connecting directly to Splitit’s merchant networks, through a direct link or through a card network. The payment option, called FI-PayLater, …

-

25 April

Visa Joins the Amazon Partner Network As Fintechs Turn to the Cloud for Payments Acceptance

Visa Inc. said early Thursday it has joined a network of service providers maintained by Amazon.com Inc. The e-commerce giant’s AWS Partner Network will enable Visa to reach new clients for its payment services, particularly fintechs and independent software vendors (ISVs) accustomed to operating through cloud computing, Visa said. The …

-

24 April

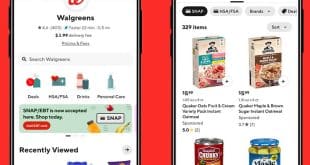

DoorDash’s SNAP at 7,800 Walgreens Stores

Consumers using SNAP and electronic benefits transfer payments at a U.S. Walgreens Boots Alliance Inc. store now have broader access to the services through DoorDash Inc., a third-party delivery service. Announced Wednesday, the deal means Walgreens shoppers can use their SNAP/EBT payments card at any Walgreens, regardless of where they …

-

24 April

Steady Consumer Spending Helps Buoy Visa As It Strikes Deals for Open Banking

Citing “relative stability” across key business metrics, such as cross-border volume, Visa Inc. late Tuesday reported March-quarter increases of 10% year-over-year in both net revenue ($8.8 billion) and net income ($4.7 billion). Driven by stable consumer spending, dollar volume grew 8%, while total cross-border dollar volume grew 16% and processed …

-

24 April

Square Broadens Offline Mode and other Digital Transactions News briefs from 4/24/24

Block Inc.’s Square point-of-sale unit announced offline-payments capability is now available on all Square devices in all geographies around the world. The move covers Square Stand and Square Reader for contactless and chip, in addition to Square Register and Square Terminal. Square Reader for magstripe, the original Square device, has been covered …

-

23 April

Beyond payment acceptance – Leveraging APIs and open banking to provide more value

By Steven Velasquez, Senior Vice President and Head of Partner Business Development – U.S. Bank | Elavon The emergence of open banking, financial services APIs, and banking as a service has changed the landscape of the payments ecosystem. It is no longer enough to offer integrated payments with your software …

-

23 April

Same-Day ACH Volume Maintains Growth Pace

Same-day ACH transactions helped fuel a strong first quarter for the automated clearinghouse network. Nacha, the governing body for the automated clearing house network, reported early Tuesday that same-day ACH transactions totaled 273.7 million during the quarter, a 47% increase from the same period a year ago. The dollar value …

-

23 April

A Fast-Expanding Clover Provides a Hot Engine for Growth at Fiserv

Fiserv Inc. has been an acquisitive payments processor in recent years, but it’s a deal the company concluded nearly five years ago that is energizing growth at the company. Fiserv’s $22-billion acquisition of First Data Corp. in the summer of 2019 brought Clover, a set of point-of-sale technologies that today …

-

23 April

MPC’s New CCCA Ad and other Digital Transactions News briefs from 4/23/24

The Merchants Payments Coalition released a 30-second TV ad that says the Credit Card Competition Act, a measure that would stipulate merchants have credit card routing choices, would prohibit China’s credit card network UnionPay from processing U.S. credit card transactions. Currently, no regulation prohibits that the MPC says. The CCCA, if passed, would …