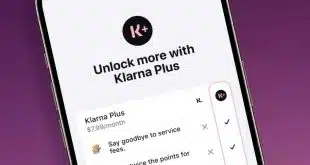

Klarna AB, a buy now, pay later provider, is entering the subscription arena with the U.S. launch of Klarna Plus. For $7.99 a month, Klarna Plus enables eligible consumers to earn double rewards points on their purchases, pay no service fee when using Klarna at merchants outside of the Klarna …

Read More »Debit a Favored Subscription Choice And Other Digital Transactions News briefs from 1/23/24

Subscription management specialist Recurly Inc. released its 2024 State of Subscriptions report that found 45.5% of consumers chose debit as the subscription payment method, followed by credit cards, 33%, PayPal, 19.3%, and other alternative payment methods, 2.2%. Wise, a platform for international money transfers, said junk fees associated with credit cards and …

Read More »COMMENTARY: Streamlining Payments with Straight-Through Processing

In today’s fast-paced business landscape, efficiency and quality are essential for staying ahead of the competition. Straight-through processing (STP) is a solution that enables businesses to expedite financial transaction processing while reducing errors and eliminating repetitive tasks. In both accounts payable and accounts receivable, STP can transform the way payments …

Read More »Synchrony To Acquire Ally’s POS Financing Unit And Other Digital Transactions News briefs from 1/19/24

Synchrony Financial said it will acquire the point-of-sale financing business of Ally Financial Inc. The portfolio includes $2.2 billion in loan receivables and includes relationships with nearly 2,500 merchant locations and more than 450,000 active borrowers in home improvement services and health care. Terms were not disclosed. Alchemy Pay, whose gateway …

Read More »Eye on Point-of-Sale: Sound Payments POS Updates Are Issued; a New PCI Council Director

Sound Payments issued a slate of updates for its point-of-sale system, including a way for retailers to categorize returns. Jacksonville, Fla.-based Sound Payments says the new return-categories feature enables merchants to catalog returns by size, reason for return, defective, and other custom variables. It also has a reporting component for …

Read More »UnionPay Touts Global Acceptance And Other Digital Transactions News briefs from 1/18/24

UnionPay, an international payment card network based in China, said it is now accepted in 183 countries and regions, with issuance outside the Chinese mainland exceeding 230 million cards in 81 countries. Issuance outside Mainland China commenced in January 2004. Consumer-finance and card issuer Synchrony said it is testing a browser extension …

Read More »Lower Costs Plus More Control Could Be Part of Fiserv’s Ambition for a Bank Charter

Giant payment processor Fiserv Inc. wants to take on another aspect of the business with its application for a special bank charter in Georgia. The charter for a merchant-acquirer limited purpose bank, if approved, would enable Brookfield, Wis.-based Fiserv to interact with card networks directly instead of operating through a …

Read More »Eye on NRF; BofA Zelle Users Grow 18% And Other Digital Transactions News briefs from 1/15/24

Banking giant Bank of America Corp. reported combined credit and debit card volume of $228.9 billion for the fourth quarter, up 3% year-over-year. The number of BofA users of the Zelle peer-to-peer payments network grew 18% to 21.5 million, while Zelle volume climbed 25% to $101 billion. Late in 2021, the …

Read More »COMMENTARY: A Rigged International Payments Market Is Bad for the U.S.—And Bad for Free Trade

On Nov. 20, 2023, Mastercard Inc. announced that its Chinese joint venture with Netsunion to process domestic payments had been approved by the People’s Bank of China and the National Administration of Financial Regulation. Was it a victory for, or a mockery of, free trade? If this landmark approval were …

Read More »Merchants Nudge Congress to Vote on the CCCA As Members Reconvene for 2024

The battle between merchants, on one hand, and financial institutions and payment networks, on the other, over the Credit Card Competition Act continues to heat up. The Merchants Payments Coalition on Thursday sent a letter to Congress signed by nearly 2,000 merchants, including hundreds of small businesses, calling on legislators …

Read More »