(Editor’s note: This is Part II of a two-part article. Part I appeared Thursday.) Interchange fees paid by merchants are the credit card industry’s second-largest revenue source. For debit cards and neobanks, these fees are a primary revenue source. The 2010 Dodd-Frank Act imposed price controls on debit interchange fees …

Read More »Search Results for:

Restaurant Price Strategies Come Under Fire As Advocates Push to Pass a Credit Card Bill

As restaurants turn to surcharging and dynamic pricing to offset rising operating costs, consumer backlash is raising concerns the practice could negatively affect customer loyalty and ultimately, restaurant profits. The backlash comes hard on the heels of the Electronic Payments Coalition’s attacks on restaurant surcharges and other price increases. The …

Read More »Eye on Bitcoin: Get Set for the Latest ‘Halving;” Bitcoin Depot Welcomes Investors for its Kiosk Deployments

Bitcoin was designed to be a medium of exchange, like dollars, but it has become over time more like an investment, such as gold. Now, Bitcoin investors and consumers alike face an event that will significantly affect the value of their holdings, drive up Bitcoin’s price, and affect the digital …

Read More »A Card Industry Group Cites Retailers’ Price Boosts And Surcharges in Its Latest Campaign to Stop the CCCA

A trade group representing card networks and issuers is taking aim at restaurant surcharges and price increases by large grocers as part of its efforts to defeat the Credit Card Competition Act. The Electronic Payments Coalition’s first salvo in its new campaign against the CCCA was fired last week. In …

Read More »Nuvei Launches Invoice Financing and other Digital Transactions News briefs from 4/12/24

Processor Nuvei Corp. launched a financing option to allow client merchants to make invoice payments through their enterprise resource planning (ERP) platforms. Health and beauty retailers lead all sellers in adoption of gift cards, followed by general merchandise retailers and sporting-goods stores, according to scores developed by Blackhawk Network and NAPCO Research …

Read More »Eye on AI: PayBlox Enlists AI for Statement Reviews; Colleen AI Tackles Rentals with Voice AI

The promise of lower credit and debit card processing fees is a big attraction for merchants to switch merchant providers. Statement reviews are a key part of that process and now PayBlox, a merchant services referral site, has enlisted artificial intelligence to help. With the debut of its Statement Spy …

Read More »Mastercard Plans a Network Fee Hike for Later This Month. Merchants Aren’t Happy

Mastercard merchants will see a network fee increase later this month when Mastercard increases its Acquirer Brand Volume Fee from 0.13% to 0.14%, effective April 15. The increase comes on the heels of last week’s settlement between Visa and Mastercard, on one hand, and merchants, on the other, in their …

Read More »PayPal, Amazon, Apple, And Walmart Are Among the Big Winners in the Interchange Deal

The transaction-cost savings and tender steering provided for in the big interchange settlement reached earlier this week will be worth hundreds of millions of dollars annually for major merchants and the big mobile-wallet providers, according to estimates provided to Digital Transactions News by San Carlos, Calif.-based payments researcher Crone Consulting. …

Read More »COMMENTARY: The Great Hope Rising From the Quiet Revolution Against Card Payments

In the heart of America’s bustling commerce, a subtle yet powerful revolution is unfolding, driven by small merchants. The strategies of offering discounts for cash payments and imposing surcharges for card transactions are at the forefront of this change. These practices, rapidly gaining traction across communities, directly challenge the entrenched …

Read More »Buying Groups Might—or Might Not—Give Merchants More Negotiating Power with the Card Networks

Card-acceptance costs and network rules weren’t the only subjects covered by the sweeping settlement revealed Tuesday involving Visa Inc., Mastercard Inc. and lawyers for the merchants that sued them. The pending agreement, which needs approval from a federal judge, allows for the creation of so-called merchant buying groups that would …

Read More »Visa And Mastercard Agree to Merchant Rate Cuts and Acceptance Changes in a Major Settlement

Merchant lawsuits challenging credit card interchange and payment card network rules that began nearly two decades ago may finally be heading for resolution under a landmark settlement announced Tuesday by Visa Inc., Mastercard Inc., and lawyers for the merchants. Merchant lawyers in the massive case estimate the settlement could save …

Read More »COMMENTARY: Cap One’s Bid for Discover Will Lift Many Boats

Capital One’s proposed $35.3-billion acquisition of Discover will be a thunderclap for the debit-card, retail-banking, and payment-network markets. The Discover network has long been the number-five U.S. retail-payment network, after Visa, Mastercard, American Express, and PayPal. Since its acquisition of Diners Club from Citi in 2008, Discover has struggled as …

Read More »CFPB’s New Card Late Fees Cap and other Digital Transactions News briefs from 3/5/24

The Consumer Financial Protection Bureau finalized a rule that caps late fees on credit card payments to $8, down from a typical $32. The rule goes into effect 60 days following its publication in the Federal Register. Other provisions include ending automatic annual inflation adjustment on the fee and requiring larger card …

Read More »Will Cap One’s Deal for Discover Create ‘True’ Network Competition? Depends on Whom You Ask

Capital One Corp.’s proposed acquisition of Discover Financial Services may give Cap One an alternative network over which to route credit card transactions, but the deal will not create the “badly needed” network competition that passage of the Credit Card Competition Act would, the Merchants Payments Coalition argues. Without passage …

Read More »Radial Adds Link Money’s Pay by Bank for Account-to-Account Payments

E-commerce platform Radial Inc. is giving its merchants a new payment option that bypasses traditional credit and debit card payments and instead relies on account-to-account transfers. Dubbed Pay by Bank, the service was developed by Link Financial Technologies Inc., which does business as Link Money, an open-banking platform. King of …

Read More »More Salvos Emerge in the Battle Over a Credit Card Networking Bill

Proponents and opponents of the Credit Card Competition Act continue to press their respective cases for passage and rejection of the CCCA by Congress. Late Monday, the Merchants Payments Coalition fired the latest salvo in its campaign to pass the CCCA, a television commercial that literally shows a consumer getting …

Read More »High Costs And Fraud Risk Drive Sellers’ Dissatisfaction With Card Processing, J.D. Power Finds

Small businesses tend to be less satisfied with their credit and debit card processing than they are with processing for alternative payments, according to a study by J.D. Power. Based on a 1,000-point scale, with 1,000 being the highest score, merchant-satisfaction scores for credit card processing averaged 692, while scores …

Read More »Eye on BNPL: Klarna Debuts a Subscription Service; PublicSquare Enlists Credova

Klarna AB, a buy now, pay later provider, is entering the subscription arena with the U.S. launch of Klarna Plus. For $7.99 a month, Klarna Plus enables eligible consumers to earn double rewards points on their purchases, pay no service fee when using Klarna at merchants outside of the Klarna …

Read More »Bit.Store’s Crypto Card And Other Digital Transactions News briefs from 1/22/24

Digital-currency platform Bit.Store launched its Visa Virtual Crypto Card, a prepaid card that can store Bitcoin and offers cashback rewards on transactions. The social-media platform X has reportedly established a “dedicated account” that could transact in cryptocurrency for the platform’s expected peer-to-peer payments service. There has been no official word so far from X, formerly …

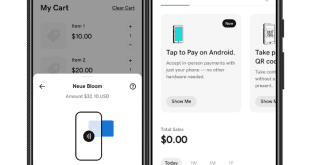

Read More »Tap to Pay on Android Comes to GoDaddy Merchants

Web services and payments provider GoDaddy Inc. released its Tap to Pay on Android point-of-sale service for merchants, complementing the Tap to Pay on iPhone technology it already offers. Tap to Pay on Android enables merchants to use consumer-grade smart phones as contactless payment-acceptance devices without a need for separate …

Read More »